Starting a forex brokerage in 2025 is easier than it’s ever been, but sustaining one is a different thing. The tools are there, white-label platforms are mature, regulations are better defined, and client demand is still strong.

Yet despite all of that, many new brokers struggle to stay operational beyond the first year. It’s not usually one big mistake that takes them down. More often, it’s a series of missteps that, in most cases, are avoidable ones.

This article walks through ten of the most common mistakes new forex brokerages make, along with practical ways to avoid them. Whether you’re setting up from scratch or working with a white-label partner, these are the areas that deserve early attention.

1. Undercapitalization

Setting up a brokerage involves more than paying for a trading platform and a company registration. You’ll need enough capital to cover licensing, liquidity, CRM tools, PSP onboarding, compliance staff (or vendors), legal advisory, tech infrastructure, and ongoing client acquisition.

And that’s just to get started.

Many brokers also underestimate monthly burn rates and forget to set aside a buffer for emergencies, upgrades, or delayed revenue. Even white-label setups still require serious financial commitment if you plan to grow. A basic package might look affordable at first, but as soon as you add in multiple platforms, tiered support, extra PSPs, or a decent affiliate system, costs escalate fast.

What often trips people up is mixing up startup capital with operating capital. You might have enough to launch, but not enough to run stable operations over six to twelve months. That gap is where many brokerages stall out, right when traction starts to build.

How to avoid it

Build a complete capital plan that includes:

- Setup fees (licensing, legal, tech stack)

- Operational runway (at least 6–12 months of burn)

- Marketing and affiliate budget (not just ads, but ongoing retention)

- Emergency and compliance reserves (fines, audits, regulatory shifts)

If you’re unsure how much capital you need, work backwards. Start with your growth targets, and then model the infrastructure you’ll need to support that growth. It’s better to delay launch by a few months than to launch half-ready and burn trust with early clients.

2. Poor Risk Management

Trading risk is only part of the picture. Operational risk is just as important, and often more immediate. Many new brokers focus entirely on offering competitive spreads and ignore what happens behind the scenes when something breaks or when volatility spikes.

Without a clear risk management framework, even a few active traders can generate exposure you weren’t prepared for. That includes things like negative balances during flash crashes, stop-outs that don’t trigger properly, or dealing desk errors that cascade across accounts.

Some brokers also take on too many asset classes too early, adding crypto or indices without having the right liquidity relationships, margin logic, or volatility controls in place. Others try to build risk logic manually, without automation or alerts, and only discover weaknesses after it’s too late.

How to avoid it

Risk management needs to be part of your infrastructure from day one. That means:

- Setting clear exposure limits by asset and trader type

- Using technology that supports automated margin recalculations and dynamic margin and leverage

- Monitoring open positions and order flow in real time

- Stress-testing your infrastructure before high-volatility events, such as CPI announcements

3. Choosing the Wrong Liquidity Provider

The liquidity provider you choose directly affects execution quality, pricing stability, and trader trust. Still, it’s one of the most misunderstood pieces of the setup process.

Some brokers select providers based only on spreads or upfront costs. Others go with whoever their white-label vendor recommends, without asking how the LP sources liquidity or whether they aggregate multiple feeds.

Execution quality is especially critical if you plan to run a B-Book or hybrid model. Poor fill rates or wide spreads not only hurt your P&L but can also trigger complaints and withdrawal requests from your most profitable clients.

How to avoid it

Before you commit to an LP, test them under live market conditions. Spreads on a brochure don’t mean much if trades don’t fill when markets move.

You’ll also want to look beyond just FX, especially if you plan to offer crypto, indices, metal, or commodities. Depth of book, pricing logic, and routing reliability all vary by asset class.

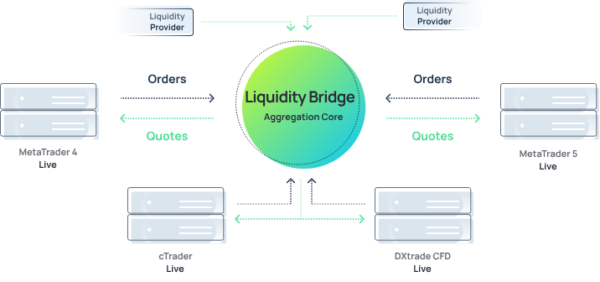

To simplify and stabilize the execution process, many brokers use aggregation tools like Brokeree’s Liquidity Bridge, which connects multiple liquidity providers to your trading platform. It helps you route orders more efficiently and apply rules based on symbol, volume, or trader profile. That flexibility becomes more valuable as you scale.

4. Overlooking Compliance Requirements

Some new brokers see compliance as a checkbox. They register a company in a low-cost jurisdiction and assume that’s the end of it. In reality, compliance is a continuous process, and regulators are paying more attention than ever.

Even in jurisdictions with lighter licensing requirements, you’re still expected to run basic AML and KYC procedures, maintain audit trails, and respond to information requests from authorities. If you can’t do that, your bank accounts can be frozen. Your PSPs can drop you. And in more regulated markets, you risk fines or license suspension.

Compliance also affects client trust. Traders want to know their funds are protected and that your brokerage isn’t running a fly-by-night operation. That trust is harder to build if your onboarding, disclosures, or documentation look improvised.

How to avoid it

Invest in automated KYC and onboarding tools early on to avoid human error and get a consistent audit trail. If you’re not ready to hire an in-house compliance officer, work with a legal advisory or outsourced compliance service that understands your jurisdiction. Many vendors now offer bundled services that include company formation, compliance setup, and ongoing monitoring, which can help you stay aligned.

Even if you’re launching in a lightly regulated market, act like you’re preparing for scrutiny. That mindset tends to pay off.

Related: How and Where to Obtain a Brokerage License

5. Weak CRM and Back Office Infrastructure

Client acquisition often gets most of the attention when launching a brokerage, but what happens after someone signs up matters just as much. Without a reliable CRM and back office setup, even a small client base can become hard to manage.

Manual onboarding, scattered lead data, inconsistent affiliate tracking, and missing KYC documents aren’t just operational annoyances. They lead to payment delays, compliance gaps, and a poor experience for both traders and IBs. Once your team grows or you start managing multiple brands, those gaps only get harder to fix.

Some brokers try to patch systems together with spreadsheets or legacy admin panels. That might work for a dozen clients, but it rarely holds up under real growth.

How to avoid it

Start with a proper Forex CRM. At a minimum, it should include:

- Automated onboarding flows (including KYC integrations)

- Multi-tier IB tracking and commission management

- Email and retention tools

- Client segmentation and analytics

- Real-time syncing with your trading platform

6. Poor payment infrastructure

For a trader, the experience of using a brokerage starts and ends with money movement. If deposits are clunky or withdrawals get delayed, that frustration overshadows everything else.

Still, payments are often treated as an afterthought. Some brokers launch with a single PSP or limited currency options. Others integrate gateways that don’t sync well with their back office, creating mismatched records and manual payout issues.

These gaps erode trust quickly, especially among first-time users or affiliates waiting on commissions.

How to avoid it

Collaborate with PSPs that have experience in the forex space and a clear understanding of the associated risk profile. Your payment system should handle more than just deposits. It needs to process withdrawals efficiently and keep records aligned with your CRM to avoid manual errors.

If you’re targeting specific geographies, local payment rails (e.g., UPI, PIX, SEPA Instant) often convert better than card-only setups. You don’t need to support every payment method at launch, but the basics should be airtight.

7. No IB or Affiliate Strategy

Most brokerages can’t rely on paid ads alone to scale. This is true for regions where advertising rules are strict or acquisition costs are high. That’s where IBs and affiliates come in. They already have access to the traders you’re trying to reach.

Many brokers launch without a clear plan for how they’ll support IBs or track referrals. The structure is often either missing or too fragile to scale. In some cases, the payout logic is unclear, and tracking is manual or delayed. That kind of friction kills long-term partnerships before they have a chance to perform.

How to avoid it

Build IB infrastructure before launch. Give partners a way to track their commissions in real time and tie their referrals directly into your CRM. If your partners can’t trust the data, or if they have to chase payments, they’ll move on.

8. Launching Without a Real Business Plan

A brokerage is a business model. Yet many new operators treat the launch like a tech rollout. They get a license, pick a platform and tech stack, build a landing page, and go live, assuming traders will follow.

But without a plan, even small decisions get harder. You lose track of what matters, and it shows up everywhere: overspending, poor hiring calls, weak client retention, confusion around roles, missed deadlines.

The risk isn’t just financial. Without a clear strategy, a brokerage might start chasing licenses it doesn’t need, mirror what competitors are doing, jump from one market to another, shift pricing midstream, or launch features just because someone else did.

How to avoid it

A proper business plan doesn’t need to be complicated, but it needs to exist. Lay out your acquisition model, operating costs, target markets, regulatory roadmap, and tech dependencies. Set clear KPIs for the first 6–12 months. And make sure your revenue assumptions match the spreads, commissions, or prop fees you intend to charge.

9. Choosing the Wrong Tech Stack

The trading platform is just one part of the equation. Your tech stack also includes your CRM, liquidity connectors, risk tools, web interfaces, analytics, affiliate portals, and sometimes prop trading modules. When these systems don’t talk to each other or require constant manual work, you end up wasting time, losing visibility, or worse, making decisions based on incomplete data.

Some brokers lock themselves into platforms that can’t scale. Others choose CRMs that don’t support the features they plan to offer six months down the line. A poor fit between systems slows everything down as you grow.

How to avoid it

Map out your operations before picking vendors. Make sure integrations are available out-of-the-box or via API, and that support teams can help when things don’t work as expected. If you’re planning on adding prop trading or multi-brand management later, it’s better to choose tools that can adapt rather than rebuild your stack every time something changes.

10. Failing to Understand Trader Behavior

A surprising number of brokers don’t spend time studying the people they’re trying to serve. They reuse standard asset offerings or bonus schemes without asking whether those actually match what their audience values.

Retail traders vary widely. Some care about spreads. Others want risk controls, instant withdrawals, or access to tools like copy trading. Prop traders look for dashboards, rules transparency, and evaluation logic they can trust. If your platform doesn’t reflect those preferences, even well-funded acquisition campaigns won’t convert.

And even when you do get signups, poor fit often shows up later—as churn, inactive accounts, or high support volume.

How to avoid it

Research shouldn’t stop at launch. Talk to traders. Ask why they leave other platforms. Track behavior in your CRM. Watch what successful competitors are doing, not to copy them, but to understand what works for a specific type of trader.

The better you know your clients, the less guesswork you’ll have to do later.

Conclusion

Running a brokerage involves a series of technical, financial, and operational decisions that compound over time. The mistakes listed here aren’t rare. They show up in audit trails, client complaints, abandoned CRMs, and partner exits. And most of them are preventable.

If you focus early on the things that keep a brokerage stable, such as capital planning, compliance, liquidity, and infrastructure, you won’t need to backtrack later.

For brokers looking to build smarter from day one, Brokeree offers tools that address fundamental operational gaps, including liquidity bridging, copy trading, CRM, automation, and risk management modules.

Book a demo to learn more about Brokeree solutions.

Up next, read our guide on how to become a forex brokerage.

FAQs

What are the startup costs for launching a forex brokerage?

Startup costs vary depending on your business model and regulatory setup. A basic white-label brokerage under an offshore jurisdiction can often be launched for as little as $20,000, covering the trading platform, CRM, and payment integration. But for brokers pursuing a more robust infrastructure, especially with their own offshore license and legal coverage, the total investment can reach $100,000 to $250,000 or more.

Do I need a license to operate a forex brokerage?

Even if you’re launching offshore, running without a license creates avoidable risk. It becomes harder to work with payment providers or maintain stable banking. Traders are also more likely to question your legitimacy if there’s no regulatory oversight in place. Jurisdictions like Saint Lucia, Seychelles, and Comoros do require licensing, with fewer upfront barriers than larger regulators. A license won’t solve everything, but it opens doors that remain shut to unregulated entities.

How do I choose the right liquidity provider?

Look for LPs with proven execution performance, strong uptime, and asset coverage that matches your offer. Avoid decisions based solely on spread. Tools like Brokeree’s Liquidity Bridge can help aggregate multiple providers and apply smart routing rules for better control.

Here’s an article that discusses this topic in more detail

Can I run a prop firm using the same infrastructure as a retail brokerage?

It depends on your tech stack. Many brokers now run hybrid setups that support both retail clients and prop trading evaluation. You’ll need infrastructure that can handle scale, whether that means tracking progress across evaluations or enforcing firm-specific risk rules. Most off-the-shelf CRMs don’t support this natively, so it’s something to map out before committing to a platform.